Inflationary pressures have many of us feeling the pinch right now, so it’s extra important to understand, and prepare for the cost of veterinary care for our pets.

Research from Animal Medicines Australia (AMA) shows 68% of pet owners had considered not going to the vet when needed, a decision driven by cost concerns*. In addition, research commissioned by PetSure shows 40% of pet owners would consider economic euthanasia if a veterinary treatment cost exceeded $3,000#.

Our furry friends can be unpredictable, and you never know when you might need to cover treatment costs for an accident or illness, so here are our top tips for managing pet healthcare costs.

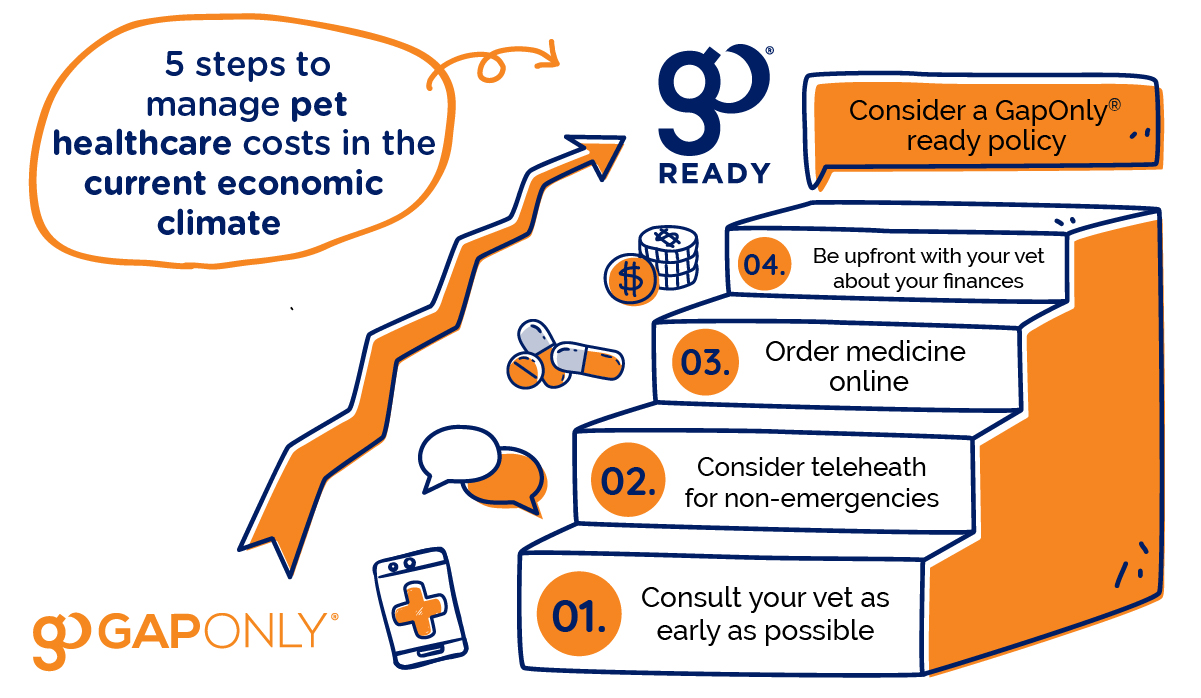

- Speak with a vet as soon as possible

If you’re concerned about your pet’s health, you should always speak to a vet. And in many cases, seeing a vet sooner, particularly for a minor concern could save money – if treatment is delayed, the illness or injury could progress to something more serious requiring more costly treatment. - Be upfront with your vet about your financial situation

If you find yourself at the vet clinic, be upfront with your vet about costs and your ability to cover veterinary costs. This might include enquiring early about the estimated treatment costs, notifying the vet of any financial constraints you may have and disclosing whether or not you have a pet insurance policy. Discussing finances early on during your vet visit can help avoid any surprises or difficult conversations later on about treatment costs. - Consider a GapOnly®-ready policy, to reduce upfront out-of-pocket costs

Available Australia-wide, GapOnly® is an innovative payment solution that allows you to claim your pet insurance on the spot, simply paying the gap**. Claiming with GapOnly® helps reduce your upfront out-of-pocket expense, which is useful from a cashflow perspective because you don’t have to pay the full invoice upfront and wait to be reimbursed later.

If you’re in the market for a pet insurance policy, consider a GapOnly® ready policy and search to find your nearest GapOnly® vet clinic.

And scroll down to the bottom of the page to read Elizabeth and Jude’s story, and the difference it made to claim with GapOnly. - Consider vet telehealth for non-emergencies

Online veterinary services offer access to video and live message consultations, where you can connect with qualified vets for advice and triage. Vet telehealth services, like VetChat, are useful for non-emergencies and queries like gastrointestinal issues (i.e. if your pet ate something it shouldn’t have) or for mild skin irritations or issues.

VetChat consultations are complimentary with a majority of PetSure administered policies, or are otherwise available for a small fee, which means you can save on any unnecessary in-person consultation fees. However, it’s important to note that vet telehealth is complimentary to in-person veterinary care. - Purchase pet prescription medications online for cost savings

In some cases, you could save money by buying pet prescription medications through an online pet pharmacy. Buying from an online pet pharmacy may be suitable when purchasing medications to help treat things like allergic skin conditions, arthritis pain, or thyroid conditions.

However, online pharmacies are not suitable for emergency situations where the medication needs to be administered immediately. If you are unsure where to buy from, enquire directly with your vet. - Consider lowering your pet insurance premium

If you’re struggling to afford your existing pet insurance payments, there are options available to help minimise costs, such as lowering your premium by changing levels of cover or opting for higher excess options.

Elizabeth and Jude’s recent visit to the vet clinic, made easier with GapOnly®

When Newcastle-based Elizabeth noticed her three-year old Border Collie, Jude, was limping again she was upset because she had only just finished paying off a loan to her parents to help cover Jude’s previous surgery.

While she’s always had pet insurance, this time Elizabeth was relieved to learn that with her RSPCA policy this time she could claim with GapOnly®, to help reduce the upfront out-of-pocket cost for Jude’s next vet visit and surgery.

“I was so lucky to claim with GapOnly®, especially for such a massive surgery. Jude’s leg didn’t develop properly as a puppy so over the years, he’s had multiple X-rays, MRIs and now two major surgeries resulting in a permanent plate and bone marrow graft. And he’s only three!

“I’m so glad I’ve always had pet insurance – it’s such a small cost for a huge benefit. For me, the cost is similar to the price of going out for breakfast with friends once a week – it’s pocket-change, really.

“You never know what your pet will get up to or when they might get sick or injured, so having insurance acts as a safety net for when you need it most.

“Having Jude’s most recent massive surgery at SASH where I could claim with GapOnly® really eased the financial burden for me. It meant we could go ahead with the procedure earlier because I didn’t have to worry about saving the full amount, or taking out another loan from my parents, or a bank loan.

“Jude is my baby. He’s my soulmate and the one I connect with most in this world. We know each other so well just through looks and I’m so lucky to spend most of my days with him. I can’t wait until he’s back to his best capacity and able to play down at the beach again next summer.”

References:

*Animal Medicines Australia report (2022), “Pets in Australia: a national survey of pets and their people”

# PetSure research on customer’s sentiment towards vet bills (Sept – Oct 2022)

~ Based on PetSure claims data for the 2022 calendar year

**The gap means the difference between the vet’s invoice and the eligible claim benefit under your policy

VetChat is a related company of PetSure (Australia) Pty Ltd

Testimonials and customer experience may vary depending on individual circumstances. Claims are assessed subject to policy terms and conditions.

GapOnly ® is a trademark owned by PetSure (Australia) Pty Ltd ABN 95 075 949 923, AFSL 420183 (PetSure). Insurance products are issued by The Hollard Insurance Company Pty Ltd ABN 78 090 584 473, AFSL 241436 (Hollard) and/or PetSure (from 8 May 2023 only), administered by PetSure and promoted and distributed through their authorised representatives and distribution partners. Any advice provided is general only and does not take into account your individual objectives, financial situation or needs. Meet our partners at petsure.com.au/partners.