So, what are some average treatment costs for pet health mishaps?

Let’s take a common health condition for a cat and a dog, and review the treatment cost based on claims data from PetSure# (the power behind GapOnly®).

If you had a three-year-old Ragdoll cat with feline lower urinary tract disease, the average annual cost for treatment would be around $1,482#.

Secondly, if you had a three-year-old Cavoodle with a gastrointestinal tract infection and an allergic skin condition, over a year this would generally involve an average of six vet visits. The average annual average cost of treatment for these conditions would amount to $2,169#.

What are some options to cover veterinary expenses?

Based on the two scenarios above and the relevant treatment costs, below are some options available to help cover veterinary costs.

1. Pet insurance

Pet insurance is an option that can alleviate some of the financial pressure if your fur baby gets unexpectedly sick or injured. Many policies pay up to 80% of the eligible vet bills up to $10,000 or more each year.

If you use PetSure’s Find a policy tool, you can find a provider and click through to populate a quote. Below is an example of what you might expect to pay for an annual pet insurance premium.

Ragdoll:

If you took out a comprehensive accident & illness cover policy* for your cat at the start of the year, your pet insurance premium would amount to $27.88 per month or $334.56 annually*.

For an eligible condition, a PetSure administered policy would reimburse up to 80% of the treatment cost, so for your Ragdoll’s urinary tract disease (average cost of $1,482), you would pay around $296.40. Combining your out-of-pocket cost with your annual pet insurance premium, the estimated pet health cost would be $630.96.

Cavoodle:

If you took out the same comprehensive accident & illness cover policy** for the Cavoodle at the start of the year, you’d pay $41.77 per month or $501.24 for the year**.

The treatment cost for the Cavoodle’s gastrointestinal tract infection (at an average cost of $2,169) would see you fork out around $433.80 where your pet insurance policy covered up to 80% of the cost. Combine this out-of-pocket treatment cost with your annual premium and your total expense would be $935.04.

Using a GapOnly® ready policy would allow you to reduce your upfront out-of-pocket cost by simply paying the gap^ while you’re still at the vet clinic.

There are other options you could use to cover the vet expense of $1,482 for your Ragdoll’s treatment or $2,169 for the scenario above – we summarise some of these options below.

2. Paying with plastic

A credit card payment enables you to make a purchase using money borrowed from the credit card provider. In some situations, a credit card could be an alternative to pet insurance.

The Reserve Bank of Australia (RBA) shows the annual interest rate for a credit card is 17.93%##. In addition, some providers also charge fees like annual fees or late fees, but to simplify this example we’ll just show the monthly repayment calculation below.

Ragdoll:

For a balance of $1,482 at 17.93% interest##, if you made a higher monthly repayment of $135, you’d pay $1,605 over a year. This calculation is an estimate using the Moneysmart.gov.au credit card calculator^^.

Cavoodle:

To repay a balance of $2,169 at 17.93% interest, if you made a higher monthly of $210 per month, you’d fork out $2,335 over 12 months^^, and remember – this doesn’t include any additional fees that may be charged by the lender.

3. A personal loan

Taking out a personal loan (What Is A Personal Loan? Types Of Personal Loans | Canstar) means you can borrow a set amount of money and repay the money plus interest over the loan period. While personal loan interest rates vary, the RBA says the average rate in Australia in August 2023 was 7.80%~.

Again, using the Moneysmart.gov.au personal loan repayment calculator we’ve calculated the personal loan repayments below.

Ragdoll:

To repay the $1,482 borrowed over a year, the monthly repayment at 7.8% interest would be $129, so an estimate annual cost of $1,545 ^^^.

Cavoodle:

To borrow $2,169 over a year at 7.8% interest, the monthly repayment would be $188, so an estimated total repayment cost of $2,262^^^.

There may be additional application fees for a personal loan, which have not been included in the above calculations.

4. Using your savings

A savings account could be a good addition or alternative to pet insurance, if you make regular contributions but keep in mind it takes time to grow your savings and it can be tempting to dip into savings when other expenses crop up, like rental payments, groceries or petrol for example.

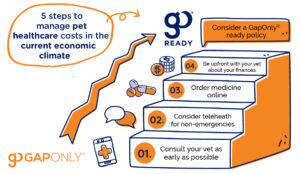

So, when thinking about your options to cover pet healthcare costs consider how you’ll fund ongoing care throughout your pet’s entire life. Being financially prepared and having a plan in place early on means you’ll be better prepared if and when things don’t go to plan.

References

*Based on a 32-year-old pet owner living in postcode 2099 with cover provided by PetSure’s direct brand petinsurance.com.au (Best in Show: Gold Cover) with a $250 excess. The quote generated was for a desexed three-year old female Ragdoll on 15 November 2023. These quotes are examples only. Actual prices and coverage will vary. You should consider the Product Disclosure Statement to determine which products are appropriate for you.

**Based on a 32-year-old pet owner living in postcode 2099 with cover provided by PetSure’s direct brand petinsurance.com.au (Best in Show: Gold Cover) with a $250 excess. The quote generated was for a desexed three-year old female Cavoodle on 15 November 2023. These quotes are examples only. Actual prices and coverage will vary. You should consider the Product Disclosure Statement to determine which products are appropriate for you.

^The gap means the difference between the vet’s invoice and the eligible claim benefit under your policy.

#Financial year 2023 PetSure data. Average annual cost reflects the average cost across all vet visits.

##According to RBA data, the average credit card interest rate is 17.93% for the month ending August – https://www.rba.gov.au/statistics/tables/

^^Calculated using the MoneySmart credit card calculator:

https://moneysmart.gov.au/credit-cards/credit-card-calculator

^^^ Calculated using the MoneySmart personal loan calculator:

https://moneysmart.gov.au/loans/personal-loan-calculator

~ Reserve Bank of Australia, personal lending rates –

total lending rates, personal credit, outstanding, fixed-term loans, August 2023

+According to Qrillpet.com

Insurance products are issued by The Hollard Insurance Company Pty Ltd ABN 78 090 584 473, AFSL 241436 (Hollard) and/or PetSure (Australia) Pty Ltd ABN 95 075 949 923, AFSL 420183 (PetSure) (from 8 May 2023 only), administered by PetSure and promoted and distributed through their authorised representatives and distribution partners.

Any advice provided is general only and does not take into account your individual objectives, financial situation or needs. Cover is subject to the policy terms and conditions. Please consider the Product Disclosure Statement (PDS) to ensure this product meets your needs before purchasing or choosing to continue with the product. PDS and Target Market Determination available on our partners’ websites. Meet our partners at petsure.com.au/partners.